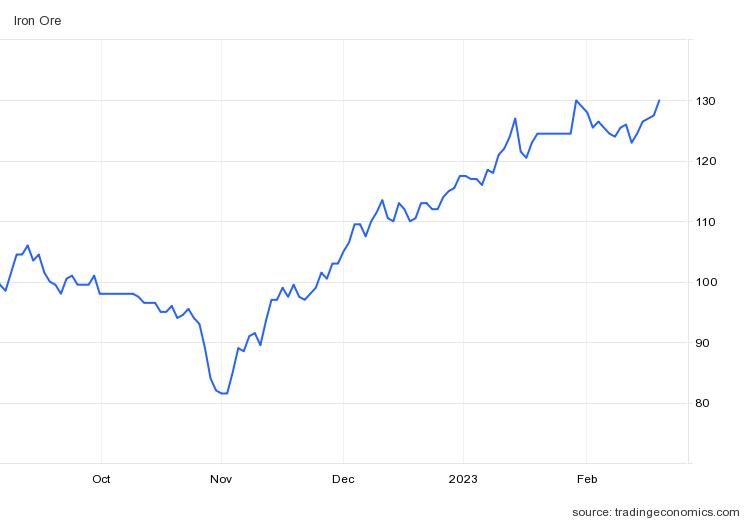

In our previous post we discussed the stabilising iron ore market and how its short-term future is tied to the actions of the Chinese Government. Unfortunately, we seem to have been on the money with our predictions for the wrong reasons. After the Chinese Government proposed a reduction in the volume of iron ore required to fulfil its strategic plan, due in part to rolling power cuts causing production stoppages in steel production plants, we saw iron ore plummet to levels last seen at the end of 2019.

Commencing late last year iron ore has risen steadily. There are many drivers for this occurrence, the main one remains the agenda of China’s Politburo. Of recent note, the Chinese Government has started to bring in foreign workers. The National People’s Congress to be held in March is also likely to bring additional economic stimulus. This is in addition to the ongoing aggressive stimulus aimed at bolstering China’s floundering property market. As a result, steel production has started to climb. This coupled with unfavourable weather conditions in Australia and Brazil and mining maintenance programs for some of the world’s largest producers have led to a much tighter market.

In the last decade there has been a sharp reduction in the exploration and capital expenditure budgets of the iron ore majors, such as BHP, Rio Tinto and Vale. This means that there is limited new production coming onstream and leads credence to the thought that if iron ore prices do fall again, the decline will be contained.